THACO AGRI is ambitious to bring HAGL Agrico back to effective and stable operation

In the second quarter of 2021, the company's net revenue was only 252 billion dong, down 50% over the same period. In which, the biggest drop was in fruit sales to nearly 200 billion dong, down 53%. Sales of rubber latex only reached 30 billion, down 23%, sales of agricultural materials 8.5 billion, down 36%; revenue from thirst products and services reached 14 billion, down 36%.

Declining revenue combined with a sharp drop in gross profit margin of the fruit segment made the company's gross profit in the second quarter of 2021 only reach VND 18 billion, down 86.3% over the same period. In the second quarter of 2021, revenue from fruit accounted for 80% of the company's revenue, but COGS accounted for more than 94% of revenue (in the same period, accounting for only 66% of revenue), eroding profits from this segment.

During the period, the company's selling and administrative expenses decreased by 36.3% to 107 billion dong. The company's brightest point in the second quarter of 2021 was its financial revenue, which increased sharply to VND 61.9 billion, up 23 times over the same period last year, mainly thanks to the transfer of investment, bringing in VND 28.4 billion. and interest on loans to other companies amounted to nearly 16 billion dong, exchange rate difference and other interest 17.5 billion dong. However, the company's financial expenses also increased sharply to 138 billion dong, mainly from loan interest (120 billion dong).

Net profit is low, expenses are high, so in the second quarter of 2021, the company has a net loss of 158 billion dong (1.7 billion dong in the same period). After calculating the loss of 5.2 billion dong from other activities (mainly loss due to liquidation of fixed assets and depreciation of deprecated assets), the company's total loss after tax in the second quarter of 2021 is 163 billion dong. dong while the same period the profit was nearly 8.5 billion dong.

In 6 months, HAGL Agrico's net revenue is 512 billion dong, down 56% over the same period. In which, fruit revenue was only 397 billion VND, down 60%, rubber latex sales decreased by 31%. Gross profit was 59.6 billion dong, down 85% over the same period.

In the first half of this year, the company's financial income increased sharply to VND 117 billion, up 29 times over the same period, but financial expenses increased 2.2 times to VND 190 billion.

Up to 52% of financial revenue (60.9 billion VND) was obtained from the profit from transferring 3 subsidiaries to THACO AGRI (Hoang Anh Quang Minh Rubber, Tay Nguyen Dairy Cow and Hoang Anh Dak Lak) to THACO AGRI with The total transfer value is more than 4,149 billion VND. In addition, the company also recorded financial income from interest on loans to other companies of 31.5 billion dong, exchange rate difference and other interest of more than 24 billion dong.

In the first half of the year, selling expenses of Hoang Anh Gia Lai Agrico decreased by 111% over the same period, to only 90 billion VND while administrative expenses were only nearly 70 billion VND, down 34% over the same period.

After deducting expenses, the company recorded a net loss of 161 billion dong, another loss of 111.7 billion dong, bringing the pre-tax loss to 273 billion dong while the profit in the same period last year was more than 11 billion dong.

In 2021, HNG is expected to reach VND 1,465 billion in revenue

As of June 30, 2021, HNG's total assets are VND 22,800 billion, down 7.3% compared to the end of 2020, mainly due to a decrease in long-term assets (long-term receivables, fixed assets). construction in progress, capital construction in progress). During the period, receivables from customers increased by 95% to VND 6,908 billion.

The company's liabilities, although reduced by 1,334 billion VND compared to the end of last year, are still very large: 14,655 billion VND. In which, the company's loan amounted to more than 12,000 billion VND, the largest creditors were THACO AGRI, Hoang Anh Gia Lai and then banks.

Specifically, the company's short-term loans are VND 8,254 billion (borrowing THACO AGRI VND 6,282 billion, borrowing from Truong Hai International Shipping and Forwarding Company VND 66.5 billion, bank loans of 1,160 (mainly HDBank and TPBank). The long-term bank loan due to maturity is VND 512 billion… The largest long-term loan is a loan of VND 2,103 billion with Hoang Anh Gia Lai, VND 1,229 billion with BIDV, and VND 683 billion with Laos-Vietnam Joint Venture Bank (Attapeu branch).

At the end of July 2021, HAGL Agrico had a resolution to agree to set off debts between HAGL Agrico and THACO AGRI for the amount transferred from 4 subsidiaries, namely An Dong Mia One Member Co., Ltd., Cao Cao Co., Ltd. Su Hoang Anh Quang Minh, Hoang Anh Dak Lak Joint Stock Company, Tay Nguyen Dairy Cow One Member Company Limited.

The amount HAGL Agrico owes THACO AGRI as of June 30 is nearly 7,296 billion VND. THACO AGRI has to pay HAGL Agrico more than 6,030 billion VND after buying 4 subsidiaries of this unit as of June 30. Thus, after clearing, HAGL still owes THACO AGRI VND 1,265.5 billion.

Previously, at the end of 2020 and the beginning of 2021, THACO AGRI received the transfer of 4 subsidiaries of HAGL Agrico mentioned above with a total area of 20,744 hectares and for VND 9,095 billion. In which, the amount of debt received (inheritance debt) is 2,595 billion VND, the amount THACO AGRI has to pay to this business is 6,500 billion VND to repay the due bank debt and to spend on investment activities of HAGL Agrico.

The land papers of these companies are being used as collateral to secure the debts of Hoang Anh Gia Lai JSC (HAGL - Code: HAG) at BIDV. At the end of July 2021, BIDV agreed to return 03 land papers to HNG to hand over to THACO AGRI in accordance with its commitment when HNG sold its subsidiaries to THACO AGRI.

THACO AGRI also pledged to continue to lend HAGL Agrico an additional 600 billion dong to spend on investment in technical infrastructure, facilities and new planting in 2021.

In 2021, HNG is expected to achieve a revenue of VND 1,465 billion, a loss of VND 84 billion and continue to invest VND 1,024 billion.

With the reduction of debt burden, more investment capital to renovate the existing fruit orchards, move towards investing in beef cattle, THACO AGRI is ambitious to bring HAGL Agrico into effective and stable operation again, bringing farmers back to life. become one of the five core business segments of Thaco.

New posts

-

Following the strong digital transformation trend across many industries, Ia Puch Cattle Farm has pr...

Following the strong digital transformation trend across many industries, Ia Puch Cattle Farm has pr...

-

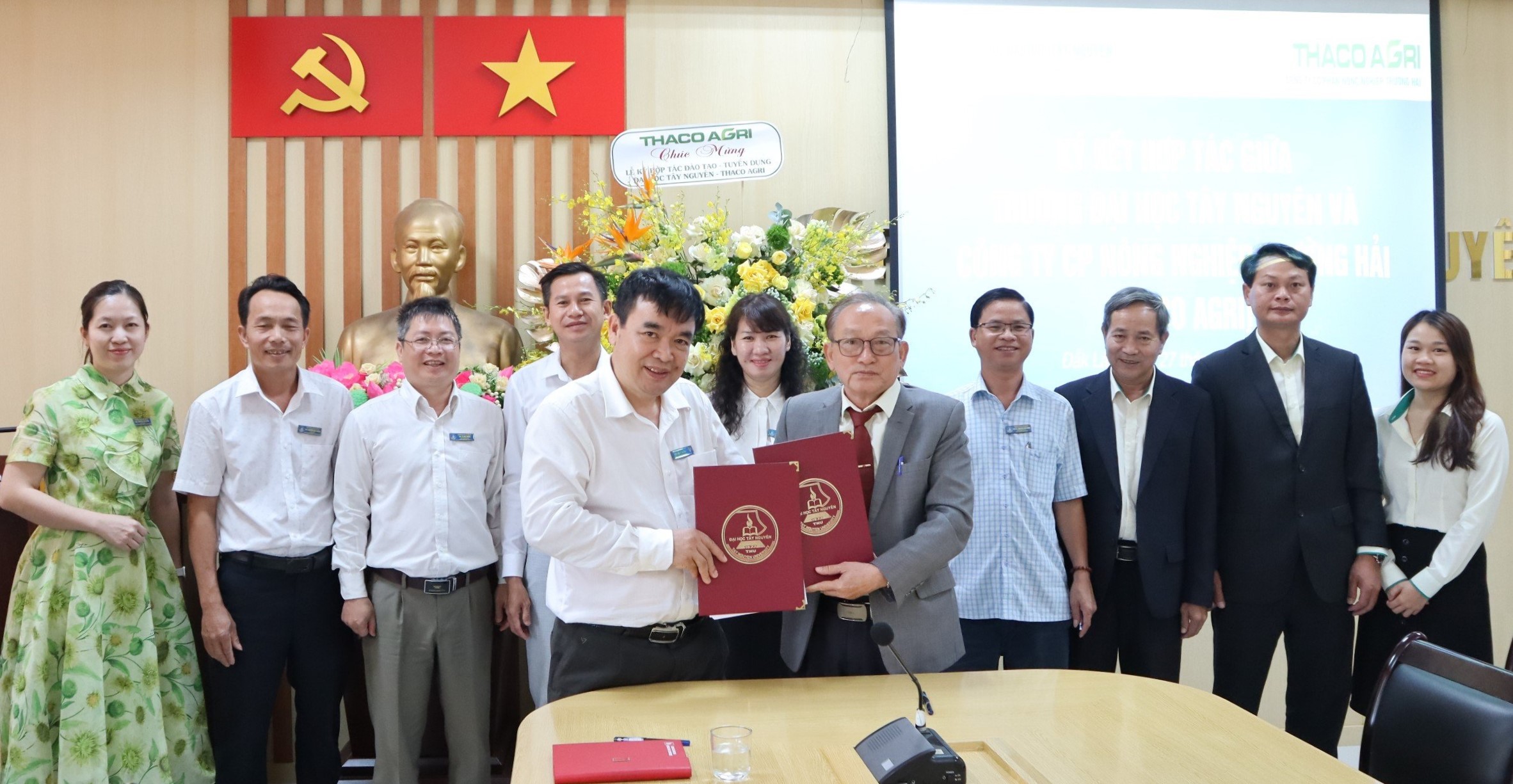

Recently, THACO AGRI has cooperated with different Vietnamese and foreign universities to recruit ta...

Recently, THACO AGRI has cooperated with different Vietnamese and foreign universities to recruit ta...

-

After the fruit care period, Cao Nguyen Durian Enterprise begins its durian season with positive pro...

Image gallery

Video gallery

THACO AGRI - A MEMBER OF THACO GROUP

The film introduces an overview of THACO AGRI.

DEVELOPING FRUIT TREES IN CAMBODIA

Cambodia encourages enterprises to develop large-scale fruit trees for export.

AMBITIONS OF THE LARGEST BANANA EXPORTER IN SOUTHEAST ASIA

THACO AGRI is not only one of the leaders but also the largest Cavendish banana tree grower in Cambodia.